💵 IVV Latest Dividend & DRP Details

- Dividend: 17.371762 cents per unit announced on July 1, 2025 nasdaq.com+4fool.com.au+4stocklight.com+4stocklight.com

- Distribution Reinvestment Plan (DRP) price set at 62.963308 cents listcorp.com+4fool.com.au+4listcorp.com+4

- Upcoming ex-dividend date (from U.S. listings) is September 16, 2025, with a projected payout of US $1.867 per share marketchameleon.com

If you’re enrolled in the ASX-listed DRP, you’ll automatically receive new units at that rate unless you opt for cash.

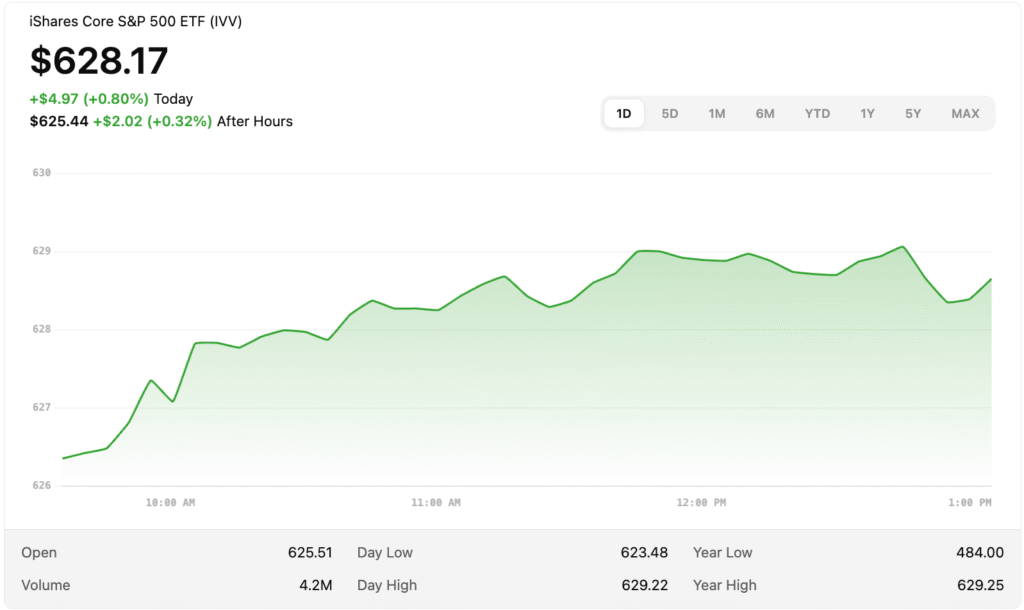

📈 IVV Price Snapshot

As of July 3, 2025, IVV is trading around US $628—a strong position reflecting steady gains in U.S. equities.

🔍 Why Investors Choose IVV

- S&P 500 exposure: Broad access to 500 major U.S. companies

- Ultra-low costs: Just 0.04% management fee on ASX marketchameleon.com+11blackrock.com+11listcorp.com+11

- High liquidity and tax-efficient structure

- Five-star Morningstar rating, with a YTD return ~6.6% ishares.com

💡 DRP vs. Cash Payout: What’s Best?

| Option | DRP (Reinvest) | Cash Payout |

|---|---|---|

| Benefit | Automatic reinvestment, compound growth | Flexible cash usage |

| Price | 62.96¢/unit | Depends on broker fees |

| Tax | Taxable on reinvested amount | Taxable on cash received |

| Best for | Long-term investors | Income-focused retirees |

🔔 Other iShares ASX ETFs to Consider

- IOZ (ASX 200): 3.3% yield, P/E ~20.6 stockinvest.us+1ishares.com+1investsmart.com.au+2stocklight.com+2fool.com.au+2

- ILC (ASX 20): Focuses on top 20 blue-chip companies; DRP pricing often announced concurrently dividendmax.com+6listcorp.com+6stocklight.com+6

These provide diversified exposure to the Australian market with reliable income streams.

✅ Final Takeaway

Whether you’re holding IVV for U.S. equity exposure or domestic iShares ETFs for Aussie diversification, the key takeaways are:

- DRP pricing gives you reinvestment clarity—IVV’s is 62.96¢ per unit

- Dividend schedule: Quarterly payouts, with next ex-div in September 2025

- Cost-effective: Notably low 0.04% fee and high liquidity

- Choose DRP if you’re in accumulation mode; opt for cash if you prefer funds now

- Explore IOZ and ILC for additional yield and AUD exposure